Vietnam, Brazil, and Indonesia are 3 key players in pepper exporting countries which occupied 71% of the total pepper export value in 2023. Traders should notice several factors including prices, competitive advantages, and support policies for better pepper trading activities.

Contents

- 1 Overview situation of world pepper exporting countries

- 2 Pepper exporting countries: Key players in the industry

- 3 Factors affecting exporting activities of pepper exporting countries

- 4 Top 10 Black Pepper Exporting Countries in 2025

- 5 Pepper exporting countries: Top 3 world’s pepper suppliers

- 6 FAQs

- 6.1 What makes Vietnam the world’s largest pepper exporter?

- 6.2 What does FAQ pepper mean?

- 6.3 What quality parameters must pepper meet for export?

- 6.4 What is the export tax rate for pepper?

- 6.5 What are the main importing markets for pepper?

- 6.6 What are current pepper price trends in 2025?

- 6.7 How is pepper processed for export?

- 6.8 How long does it take to prepare pepper for export?

- 7 Conclusion

Overview situation of world pepper exporting countries

Most experts share the same expectation that the export price of pepper will continue to increase because of the supply and demand returning to equilibrium. There may even be a shortage if the production situation is not favorable.

- In 2023, the amount of pepper exported increased by 16.6% over the previous year, reaching 267,000 tons. The US was the top purchaser of Vietnamese pepper, accounting for 23.5% of the total export value. China was the second-largest export market, accounting for 14.1%.

In Q1 2025, Vietnam continues to lead in global pepper exports, but with a total output projected to decrease by 15% compared to last year. Additionally, Brazil’s pepper production is expected to decline by 18-23%, reaching levels between 85,000 and 90,000 tons due to the impacts of El Niño.

| Countries | Export (Tons) | Compared to 2022 (%) |

| Vietnam | 264,094 | 13.8% |

| Brazil | 80,727 | -6.5% |

| Indonesia | 28,000 | -25.6% |

| India | 21,000 | -7.8% |

(Source: International Pepper Community – IPC)

Pepper exporting countries: Key players in the industry

According to OEC, the top 3 leading countries in exporting pepper include Vietnam, Brazil, and Indonesia in the first half of 2025.

| Countries | Export value (M) |

| Vietnam | $141.1M |

| Brazil | $156.4M |

| Indonesia | $111M |

The top 3 leading pepper exporting countries in 2019

(Source: The Observatory of Economic Complexity – OEC)

Vietnam

According to data from the General Department of Customs, Vietnam’s pepper exports in March 2025 reached 25,917 tons, worth $111.6 million USD, an increase of 92.7% in terms of volume and doubled in value compared to the previous month. However, compared to the same period last year, it decreased by 27.3% in volume but increased by 5% in value. These positive figures help Vietnam remain in the top position among pepper exporting countries with key markets including China, the United States, India, and the EU.

Vietnam’s pepper exports in the period 2012-2021

In the first quarter, black pepper prices in the domestic market increased by 16 – 18.6% to 92,500 – 96,000 VND/kg, the highest level in the past 7 years and have shown signs of slowing down and cooling down since April. Although domestic pepper prices increased, Vietnam pepper exports average price remained stable in the first 2 months of the year, fluctuating at 3,900 USD/ton for 500 g/l and 4,000 USD/ton for 550 g/l. Vietnam’s export price of white pepper is low fluctuated at 5,700 USD/ton, stable compared to the end of last year and increased 16.8% over the same period.

Vietnam pepper export price in 2021

Vietnam pepper export has proven its reputation in the international market due to several factors:

- Price: Commercial operations between Vietnam and the EU have been boosted thanks to the government’s assistance in signing EVFTA. The black pepper export tariff has been decreased by 99%, resulting in a significant decrease in the black pepper export price, giving the country a price edge over other pepper exporting countries.

Price

- The stable pepper quantity: The enormous agricultural area in Vietnam has resulted in rising pepper production over time. From 51.300 ha in 2010 to about 160.200 ha in 2025, the growing acres have been steadily increasing. In which, the Central Highlands accounts for about 60% of the country’s pepper growing area with more than 70,000 hectares, of which Dak Lak province accounts for about 40.8% of the entire region’s pepper area, equivalent to 28,583 hectares of pepper cultivation, the estimated output is expected to reach nearly 74,630 tons.

The stable pepper quantity

- High-quality final products: Because of the fertile basalt soil and the high quality of the harvest due to the intercropping of pepper and coffee, the pepper from Vietnam – one of the pepper exporting countries – is large, firm, hot, and aromatic. Pepper is also sun-dried to a moisture level of 13% without going through any chemical processes. Furthermore, producers carefully remove low-quality seeds to ensure that pepper is acceptable for export and meets all international standards.

High-quality final products

Vietnam’s position as the leading competitor in pepper exporting countries has been linked to competitive advantages such as crop area, geographical location, price, and quality.

Brazil

According to data from TRIDGE, Brazil’s pepper exports for the whole year 2023 reached 80,727 thousand tons, earning 248.5 million USD, down 7.36% in volume and down 19.50% in value compared to the previous year. Pepper from Brazil is distributed in 111 countries around the world. Vietnam became the new leading country as the largest consumer of Brazilian pepper, accounting for more than 50 million USD of total export value, accounting for about 20% of export share to Vietnam compared to the global market.

Brazil’s pepper exports in the period 2012-2021

- By 2022., Europe is Brazil’s top pepper exporting country, however, the presence of Salmonella bacteria on pepper is one of the issues limiting Brazil’s shipments to Europe. Black pepper shipments from Brazil – one of the pepper exporting countries – to the EU will be required to include a certificate and analytical findings demonstrating the absence of salmonella germs.

Salmonella bacteria on pepper

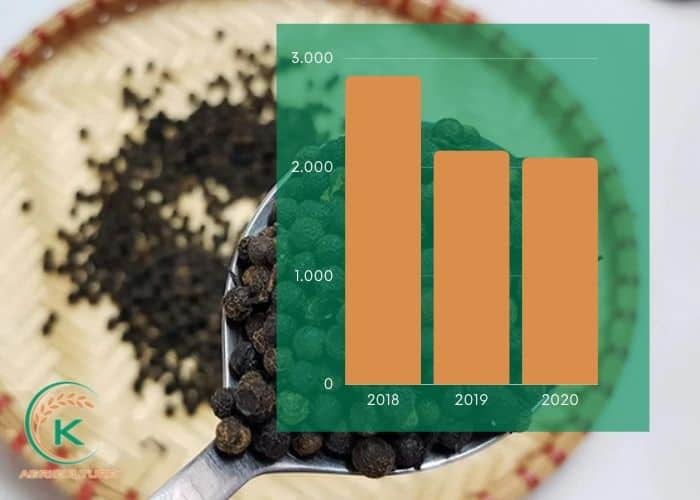

- In Brazil, export pepper prices have fluctuated over the past 3 years. By the end of 2022, the average pepper export price dropped to the lowest level in the past 5 years, about 2,500 USD/ton. After that, its average price gradually increased, fluctuating around more than 3,200 USD/ton in 2023 and continued to increase extremely rapidly from the beginning of 2025. Currently, the price of Brazilian ASTA 570 black pepper was $6,750 per ton on October 26, 2025.

The price of pepper exports has fluctuated during the last three years

- The advantage of one of the pepper exporting countries – Brazil stems from the long history of pepper production and suitable soil condition: lowland, rain, and weather, Brazil dominates the black pepper market. With its reputation, the international market always acknowledges Brazil pepper as a top choice for pepper trading.

Suitable soil condition

Indonesia

According to data from the Indonesian National Logistics Agency (Bulog), Indonesia’s pepper exports will continue to decline sharply in 2022 and 2023, reaching only 29,580 tons and 23,828 tons, respectively, equivalent to a decrease of 16.5% %. In the long-term period from 2009 to 2025, the export value of Indonesia – one of the pepper exporting countries – fluctuated over the years. Indonesia is famous for the production of white pepper mills, which accounted for nearly half of the global market. White pepper accounts for around a third of all pepper produced in Indonesia.

Indonesia’s pepper exports in the period 2009-2019

Indonesia’s key pepper export markets include China, Vietnam, the US, and India. In the first seven months of the year, China remained the largest market for Indonesian pepper, importing 4,844 tons, which is a 63.1% increase compared to the same period last year, accounting for 21.2% of Indonesia’s market share. Vietnam is the second-largest customer, with imports reaching 4,492 tons, nearly doubling with a 98% increase from the previous year and representing almost 20% of Indonesia’s total pepper exports at an import price of $4,430/ton, up 3.6%. Additionally, exports to other major markets surged, including the US (+64.5%), India (+15.9%), Japan (+17.6%), and Singapore (+123.1%).

Exporting pepper to Vietnam, USA, China

In line with the pepper exporting countries’ trend, the price of Indonesian pepper has risen in the last three years. The increasing trend began in June 2023 with a low of 3600 USD/MT and quickly accelerated to 6,691 USD/MT in October 2025.

The price of Indonesian pepper has risen in the last three years

Indonesia’s pepper production, export value, and productivity decreased to focus on supplying the domestic market.

Factors affecting exporting activities of pepper exporting countries

Traders should acknowledge the following factors, which affect the pepper exporting prices.

Demand and supply volume

- Demand: The price of pepper has recently risen as a result of a demand surplus in comparison to supply quantity. The pepper export price has grown dramatically in 8/2021, due to the ease of social distancing orders in various EU nations, as well as increased demand during important holidays such as Christmas and New Year.

Demand

- Supply: Due to the obvious influence of the irregular climate in the world’s top pepper export country, Brazil, which causes the harvesting season to be postponed, the pepper production volume has decreased. Furthermore, during the Covid-19 epidemic, transportation restrictions stalled the delivery of pepper to consumers. As a result, pepper prices surged, creating difficulties for traders.

| 2022 | 2023 | 2025 Forecast | 2023 vs. 2022 (%) | Proportion in 2023 (%) | |

| Vietnam | 183,000 | 190,000 | 170,000 | 3.8% | 35.3% |

| Indonesia | 70,000 | 65,000 | 65,000 | -7.1% | 12.1% |

| Brazil | 115,000 | 95,000 | 105,000 | -17.4% | 17.6% |

Production of pepper (MT). Source: International Pepper Community – IPC

Government policies

The government of pepper exporting countries’ support plays a critical role in the pepper industry. Agreements to eliminate tariffs, such as SAFTA, EVFTA, and others assist the pepper exporting activities by lowering prices and promoting the pepper industry to develop.

Government policies

Shipment

Because goods transportation among pepper exporting countries is blocked, logistical expenses will rise, leading to a fall in pepper export volume. Container congestion at ports may result in a shortage of pepper and a reduction in domestic purchasing. Similarly, the present “super-economic” cycle forces the United States and other countries to pump money into the market, raising fuel and petrol prices. As a consequence, the freight cost pushes the pepper export prices.

Shipment

The gap between world supply and demand for pepper has been gradually narrowing in recent years. In addition, high input costs such as labor, fertilizer, gasoline, transportation charges, etc. are expected to continue to push pepper prices up in 2025.

Top 10 Black Pepper Exporting Countries in 2025

In 2025, the world black pepper market will still be dominated by Vietnam, Brazil, and Indonesia due to their strong production capacity and competitive prices. Combined, the top 10 black pepper exporters share more than 85% of all black pepper trade in the world, reflecting a very concentrated export market.

The following are the top 10 countries that exported the highest dollar value of black pepper in 2025, whether the shipped black pepper was crushed, ground, or neither.

| Rank | Country | Export Value (USD Million) | Global Share (%) | Volume (Tonnes) |

| 1 | Vietnam | $1,200.0 | 43.2% | 124,133 |

| 2 | Brazil | $311.3 | 11.6% | 63,000 |

| 3 | Indonesia | $285.9 | 10.6% | 17,835 |

| 4 | Sri Lanka | $171.3 | 6.4% | N/A |

| 5 | India | $114.1 | 4.2% | N/A |

| 6 | Germany | $88.3 | 3.3% | N/A |

| 7 | Netherlands | $75.2 | 2.8% | N/A |

| 8 | United States | $47.7 | 1.8% | N/A |

| 9 | Maylaysioa | $41.0 | 1.5% | N/A |

| 10 | French | $40.2 | 1.5% | N/A |

Vietnam maintains its overwhelming dominance in the global black pepper export market, controlling over 43% of worldwide exports and earning $1.2 billion in 2025. The country exported 124,133 tonnes of pepper in the first six months of 2025 alone, with black pepper accounting for 105,939 tonnes of this total.

Pepper exporting countries: Top 3 world’s pepper suppliers

Here are 3 pepper suppliers that gained their reputation through developing history:

K-Agriculture

K-Agriculture is one of Vietnam’s reliable black pepper manufacturers. With a 25-year track record of supplying agricultural products to the international market, K-Agriculture has established itself as a reliable supplier to major importers in Asia and Europe. The company’s reputation among pepper exporting countries has been established through high-quality products at competitive costs. Many certificates, such as HACCP, ISO 9000, and FSSC 22000, have already been obtained by the company.

Contact information:

- Email: info@k-agriculture.com

- Website: https://k-agriculture.com/

- Whatsapp: +84855555837

K-Agriculture

Arco Associados

Arco Associado is a Brazilian firm created in 2008. It is situated in Vitória. It is an exporter with over ten years of experience supplying and exporting agricultural goods to a range of worldwide markets, including rice and black pepper, white pepper, black pepper powder, etc. Arco Associados’ main pepper export markets are the European Union, Germany, the United Arab Emirates, and Pakistan.

Arco Associados

PT Agri Spice

Pt. Agri spice (Indonesia) has been one of Indonesia’s major spice producers and exporters for the past two decades. It specializes in ensuring superior agricultural commodities such as vanilla, nutmeg, black pepper, white pepper, black pepper powder, and cinnamon to North America, Europe, Asia, Australia, and other pepper exporting countries.

PT Agri Spice

FAQs

What makes Vietnam the world’s largest pepper exporter?

Vietnam benefits from ideal tropical climate, competitive labor costs, favorable soil conditions, and over two decades of export experience. The country exported 250,600 tonnes in 2024, with 124,133 tonnes in the first half of 2025 alone.

What does FAQ pepper mean?

FAQ stands for “Fair Average Quality” – a standard grade of pepper with specific density requirements (typically 500GL to 600GL), natural color, and moisture content below 14%. This is distinguished from MC (Moisture Content) pepper grades.

What quality parameters must pepper meet for export?

Exported pepper must have moisture content below 14%, specific density ranges (500-600GL), be free from foreign matter, have acceptable color consistency, and pass tests for pesticide residues, mycotoxins, and microorganisms like Salmonella.

What is the export tax rate for pepper?

Most countries, including Vietnam, apply 0% export tax and 0% VAT on pepper exports to promote international trade.

What are the main importing markets for pepper?

The United States ($540.5 million), India ($265.8 million), and Germany ($165.5 million) are the largest importing markets globally.

What are current pepper price trends in 2025?

Vietnamese black pepper reached $6,490 per tonne in September 2025 (up 2.4%), while white pepper commands premium prices at $8,679 per tonne. Indonesian prices nearly doubled to $7,325 per tonne in Q2 2025.

How is pepper processed for export?

Processing involves harvesting at optimal maturity, sun-drying to achieve proper moisture content, sorting by size and quality, cleaning to remove foreign matter, and packaging in moisture-proof containers.

How long does it take to prepare pepper for export?

Experienced exporters typically prepare containers within 5-7 working days after order confirmation, including quality control, documentation, and packaging.

Conclusion

If you want to understand more about the pepper industry and wholesale pepper on a global scale, please visit our website: k-agriculture.com or contact us by Whatsapp: +84855 555 837

Please Post Your Comments & Reviews